Ontario online casinos more than compensate for flat betting quarter

iGO figures show new quarterly records in handle, GGR and tax revenue

Summer slowdown? Not so much in Ontario, at least on the iGaming side.

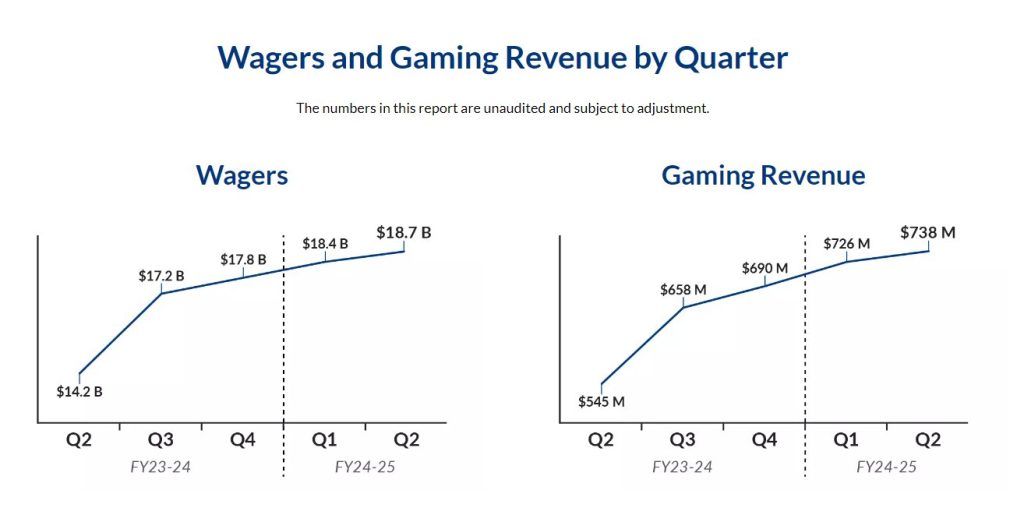

Commercial operators in Ontario’s regulated gaming market took $18.7 billion in wagers in the second quarter of the year alone, from July 1 to Sept. 30. That handle, as well as the gross gaming revenue figure of $738 million, are both quarterly records and both up more than 30% from the second quarter of last year.

The latest quarterly revenue report published by iGaming Ontario (iGO) on Thursday illustrates that the province’s regulated online gaming market continues to take big strides on a yearly basis, even if the quarterly gains are flattening out.

Across online gaming, online sports betting and online poker, overall handle was up 31.7% year-over-year and 1.6% quarter-over-quarter, while Ontario gaming sites made a total of $730.7 million in gross revenue, up 35.2% year-over-year and 1.7% quarter-over-quarter.

The curves are flattening, as one would expect, but business keeps growing.

Given that Ontario’s tax rate on online gambling is 20%, the province took $147.6 million in tax revenue last quarter, also a new record. Ontario has now reaped more than $1 billion mark in online gambling taxes alone since the market opened two-and-a-half years ago.

Sports betting handle up marginally from 2023

The iGO data encompasses 51 operators and 83 gaming platforms as of the end of Q2 2024. For comparison, this time last year, iGO said there were 47 operators and 71 sites live.

The snapshot provides an interesting insight into how online sports betting is faring vs. online casino. The answer: iGaming remains the undisputed king.

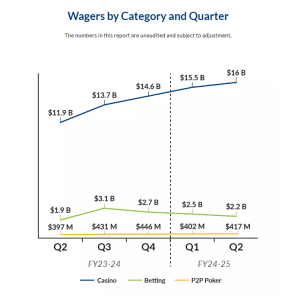

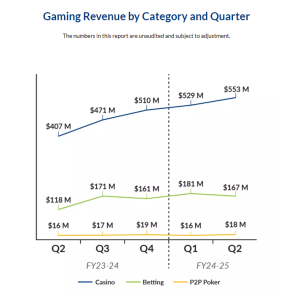

As it was last quarter, online casino rules the roost by some distance. Casino games, including slots, table games and peer-to-peer bingo, accounted for 86% of the total wagers ($16 billion) and 75% of the GGR ($553 million) in the province in Q2. Those online gaming dollar amounts were up 34.5% and 35.9% year-over-year, respectively.

In contrast, online sports betting handle fell for the third quarter in a row to $2.2 billion, likely due largely to the seasonality of sport, and was up a modest 15.8% from Q2 2023. The yearly gain was much more pronounced in wagering GGR, which rose 41.6% from Q2 2023 to $167 million, though it was down 7.7% from last quarter.

iGO noted that betting, which includes not only sports but also esports, proposition and novelty bets and exchange betting, accounted 12% of total handle last quarter.

In addition, iGO reported that more than 1.3 million player accounts were active during Q2, up 40% from 943,000 this time last year.

Average spend per player account continues to climb both year-over-year and quarter-over-quarter, hitting $308 compared to $191 last year and $284 last quarter.

OLG claims 21% of regulated Ontario online market

iGO data does not account for either the Ontario Lottery and Gaming Corporation’s business or unregulated grey-market operations.

In OLG’s 2023-24 full-year report published recently, the crown corporation posted total online gaming and sports betting GGR of $630 million, up 12% from last year. That report covered the period from April, 1 2023 to March 31, 2024; since then, iGO has reported data for two quarters.

Given that iGO reported $2.4 billion in total FY 2023-24 GGR, total revenue for the second fiscal year of Ontario’s open market was just over $3 billion, up 54.5%. That would seem to mean that OLG held down 20.8% of Ontario’s regulated online gambling market in FY 2023-24 in terms of total GGR.

Overall, combining OLG and iGO reporting, regulated online gambling in the province has yielded fractionally less than $5 billion in GGR across the first two years of Ontarii’s open market from April 4, 2022 to March 31, 2024.